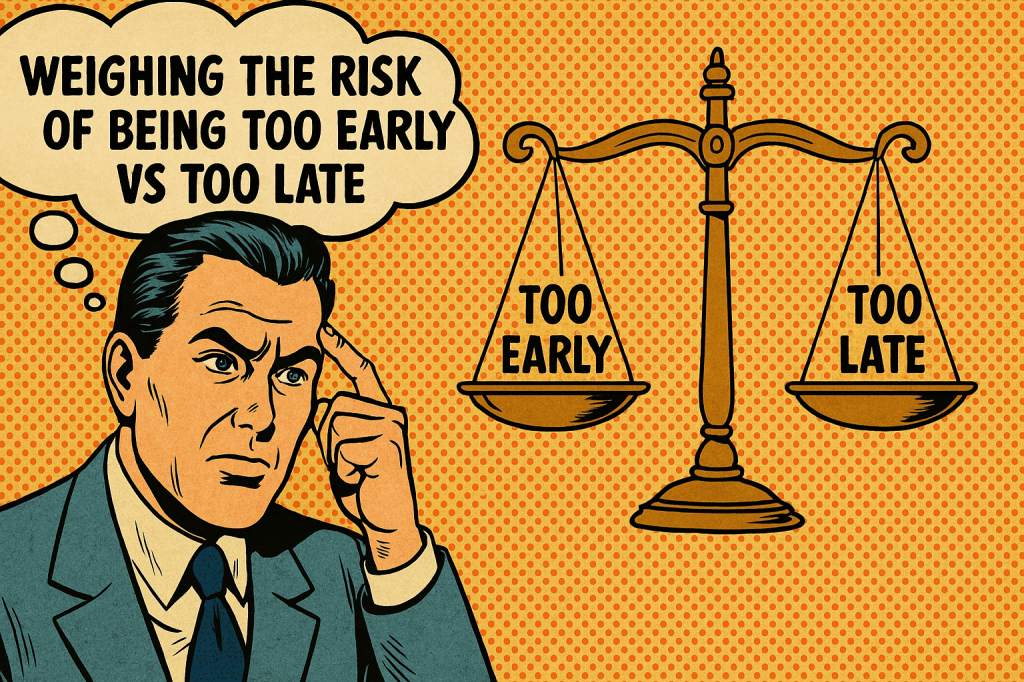

Is your organization at risk of being too early to the AI party, or too late to matter?

Is your organization sprinting toward AI adoption or inching along the sidelines? Both extremes can crush value. Act before the tech or market is ready and you burn capital. Wait for perfect clarity and competitors pass you by. Winning leaders master the sweet spot: they experiment early, but only where there is a credible path to profitable revenue, and they bake in a clear stop-loss if results do not materialize.

What History Teaches About Timing

Think of innovation history as a long-running movie about timing. Some players burst onto the screen too early, winning applause from futurists but empty wallets from buyers. Others arrive fashionably late, discovering the party has moved to a cooler venue. Only a few walk in just as the music peaks, cash in hand and product in pocket.

- Apple Newton vs. iPhone: Newton proved the concept years too soon; the iPhone launched when components, networks, and consumer behaviors aligned.

- GM EV1 vs. Tesla: GM’s electric pioneer lacked charging infrastructure and market demand; Tesla timed its debut with falling battery costs and eco-tailwinds.

- Blockbuster vs. Netflix: Streaming looked niche until broadband became ubiquitous. Blockbuster hesitated and lost the market it once owned.

- IBM Watson vs. ChatGPT: Watson dazzled on Jeopardy! but struggled to generalize, whereas ChatGPT struck when intuitive chat interfaces met broad public curiosity.

The pattern is clear: an early mover wins only when the surrounding ecosystem can sustain scalable, profitable growth.

From Anecdote to Action: A Readiness Framework

It is easy to point at cautionary tales, but far harder to decide “Should we jump now?” In executive war rooms worldwide, that single question dominates slide decks and budget debates. Before you write the next check, pause at four gates:

- Strategic Fit: Does AI solve a mission-critical problem or merely scratch an innovation itch?

- Market Maturity: Are peers already generating ROI, or are most use cases still proofs of concept?

- Organizational Capacity: Do you have clean data, sound governance, and talent that understands both AI and the business domain?

- Risk Appetite & Governance: Can you fund controlled pilots and shut them down quickly if metrics fall short?

Passing through all four gates does not guarantee success, but skipping any one is like building a bridge without the middle span.

When Being Early Is a Feature, Not a Bug

If your answers came back green, congratulations, you may be ready to step out in front. Early, however, is not synonymous with reckless. The smartest pioneers tie their boldness to a fiscal seat belt:

- Profitable Revenue Roadmap: Draft a line of sight to margin-positive performance within a set horizon.

- Stop-Loss Trigger: Commit to KPIs and a sunset date. If adoption, cost, or risk thresholds are not met, shelve or pivot.

- Iterative Funding: Release capital in stages tied to hard milestones, limiting downside while preserving speed.

These constraints may sound unromantic, yet they keep early bets from turning into bottomless pits.

Knowing When to Stop

Even the best pilots can stall. Leaders who cling to pride projects burn cash that could have powered the next winner. Watch for four flashing red lights:

- Stalling Traction: User adoption plateaus despite targeted change-management pushes.

- Shifting Economics: Compute, data, or compliance costs erode projected margins.

- Strategic Drift: The pilot’s goals diverge from core business priorities.

- Better Alternatives: New vendors or open-source models deliver the same value faster or cheaper.

Institute quarterly go-or-no-go reviews; retire or repurpose any initiative that fails two consecutive health checks. Capital freed today funds tomorrow’s breakthroughs.

Moving From Concept to Cash: Three Steps

Once the green lights stay on, it is time to leave PowerPoint and hit the factory floor:

- Prioritize High-Value Use Cases: Hunt for pain points with measurable upside such as cycle-time reduction, revenue lift, or cost savings.

- Run Controlled Pilots: Use real data and real users. Measure ruthlessly and iterate weekly.

- Scale What Works: When KPIs prove profitable potential, invest in robust data pipelines, cloud infrastructure, and upskilling.

These steps look simple on paper and feel grueling in practice; disciplined execution is exactly what separates AI winners from headline chasers.

The Bottom Line

The AI race is not about being first or last; it is about being right. Move when the value path is visible, learn fast through disciplined pilots, and stop faster when evidence says so. Organizations that master this rhythm will convert AI hype into durable, profitable growth, while their rivals are still debating the next move.

Because in the end, it’s not about being early or late, it’s about being ready.

#DigitalTransformation #CPO #CTO #CIO #FutureOfWork